Finance tips

What is the best subscription tracker of 2026?

Subscription sprawl doesn’t happen all at once. It builds gradually as teams add tools, seats, and renewals without oversight. This guide explains how the “best” subscription tracker changes by company stage, and how to choose without overbuying.

TL;DR: Choosing the Right Tool for Your Scale

TL;DR: Choosing the Right Tool for Your Scale

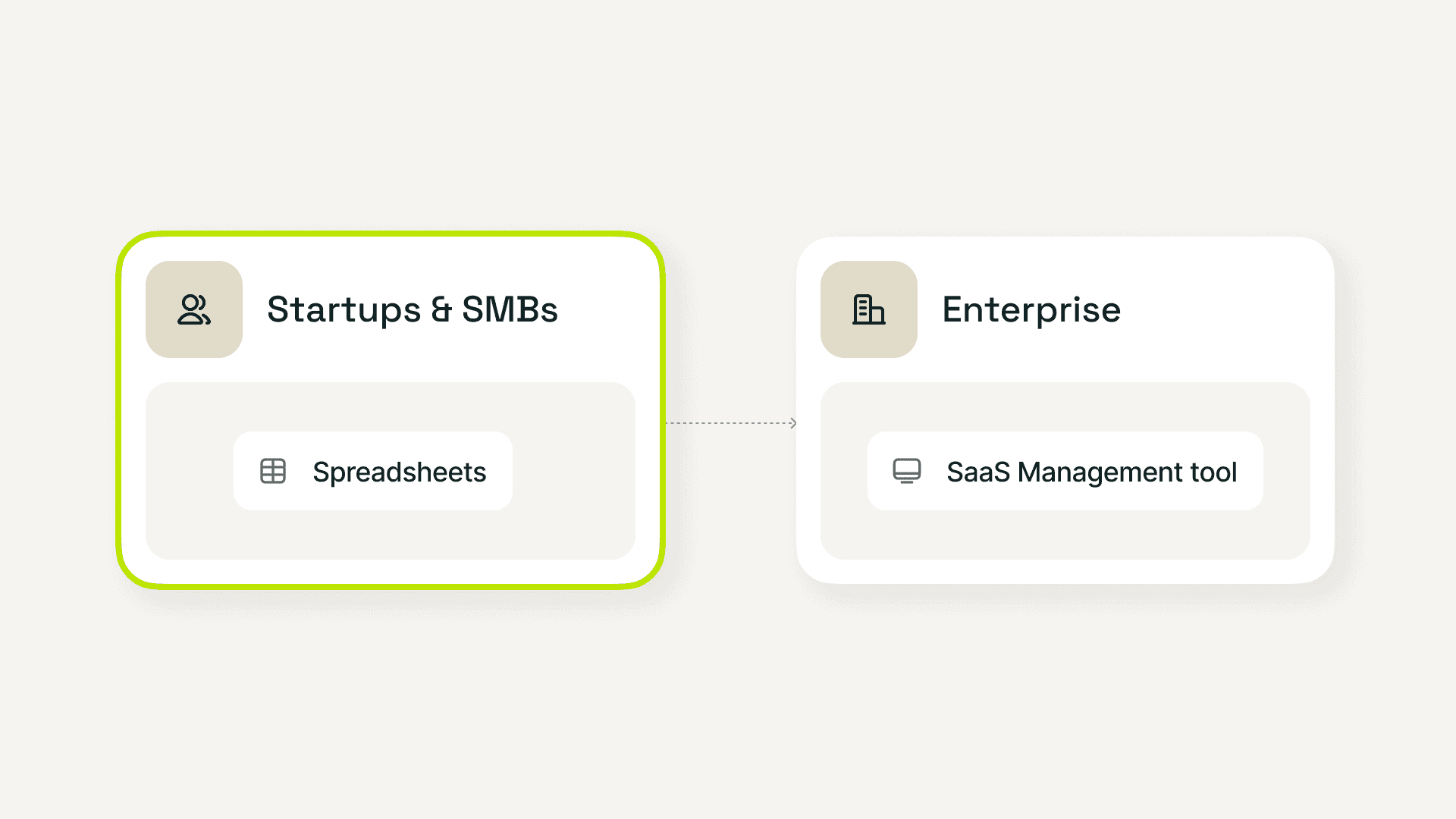

Startups and lean SMBs (1–100 employees)

The “best” option is a dedicated subscription tracker. At this stage, teams need visibility, ownership, and renewal control without procurement bloat or long implementation cycles.

Mid-market and enterprise (100+ employees)

The “best” shifts toward SaaS management platforms designed to integrate with ERPs and identity systems, supporting license optimization and formal governance at scale.

The bottom line

Companies without a system typically waste a material share of SaaS spend through unused licenses, duplicate tools, and surprise renewals. This is a structural problem, not an edge case.

Immediate action

If you are a growing B2B team looking for a dedicated, automated tracker, start with Subsight to see how subscription control works in practice.

Startups and lean SMBs (1–100 employees)

The “best” option is a dedicated subscription tracker. At this stage, teams need visibility, ownership, and renewal control without procurement bloat or long implementation cycles.

Mid-market and enterprise (100+ employees)

The “best” shifts toward SaaS management platforms designed to integrate with ERPs and identity systems, supporting license optimization and formal governance at scale.

The bottom line

Companies without a system typically waste a material share of SaaS spend through unused licenses, duplicate tools, and surprise renewals. This is a structural problem, not an edge case.

Immediate action

If you are a growing B2B team looking for a dedicated, automated tracker, start with Subsight to see how subscription control works in practice.

Why Subscription Tracking Became a 2026 Priority

The SaaS sprawl problem (from startups to enterprises)

Over the past decade, software buying has quietly decentralized. Teams no longer wait for annual IT plans or central approval cycles. They swipe a card, spin up a tool, and move on. The result is an explosion of SaaS across companies of every size, from five-person startups to global enterprises.

What makes this sprawl particularly costly in 2026 is not the number of tools alone, but how they behave financially. Most SaaS products default to auto-renewal. Pricing models shift without much notice. Seats are added incrementally and rarely removed. Licenses assigned to former employees continue billing long after access is revoked. Industry research summarized in B2B software spend analysis consistently shows that 30% of licenses go unused.

This is why subscription tracking has moved out of the “ops hygiene” bucket and into a shared finance and operations concern. Finance teams care because recurring costs compound quietly and distort forecasts. Ops teams care because tool sprawl slows onboarding, creates duplication, and obscures accountability. At larger organizations, SaaS visibility is now discussed alongside procurement and governance, as reflected in broader SaaS market growth analysis projecting the sector to reach $375.57 billion by 2026.

The common thread is that subscription spend is no longer incidental. It is structural.

Why spreadsheets, calendars, and Notion stopped working

Most companies begin with good intentions. The early-stage setup is familiar: a Google Sheet listing tools and costs, paired with calendar reminders for renewal dates. Sometimes this evolves into a Notion page maintained by whoever last touched the problem. For a while, this feels sufficient.

Then the cracks appear.

Data goes stale because seats change faster than spreadsheets are updated. Ownership becomes unclear as tools are bought by individuals rather than roles. Renewal alerts depend on manual reminders that are easy to miss during busy cycles. Finance sees only card charges or invoices, not which tool or team they belong to. These failure points are well documented in founder discussions such as subscription tracking spreadsheets discussion, where teams describe discovering months of wasted spend only after a card fails or a renewal hits unexpectedly.

As companies grow, these issues compound. Manual systems do not scale with headcount, tool count, or purchasing autonomy. This is the moment where teams transition from improvised tracking to defined software categories: dedicated subscription trackers for visibility and control, and, later, broader SaaS or spend management platforms for governance. For a practical breakdown of how hidden costs accumulate before this transition, see hidden monthly subscriptions.

Why Subscription Tracking Became a 2026 Priority

The SaaS sprawl problem (from startups to enterprises)

Over the past decade, software buying has quietly decentralized. Teams no longer wait for annual IT plans or central approval cycles. They swipe a card, spin up a tool, and move on. The result is an explosion of SaaS across companies of every size, from five-person startups to global enterprises.

What makes this sprawl particularly costly in 2026 is not the number of tools alone, but how they behave financially. Most SaaS products default to auto-renewal. Pricing models shift without much notice. Seats are added incrementally and rarely removed. Licenses assigned to former employees continue billing long after access is revoked. Industry research summarized in B2B software spend analysis consistently shows that 30% of licenses go unused.

This is why subscription tracking has moved out of the “ops hygiene” bucket and into a shared finance and operations concern. Finance teams care because recurring costs compound quietly and distort forecasts. Ops teams care because tool sprawl slows onboarding, creates duplication, and obscures accountability. At larger organizations, SaaS visibility is now discussed alongside procurement and governance, as reflected in broader SaaS market growth analysis projecting the sector to reach $375.57 billion by 2026.

The common thread is that subscription spend is no longer incidental. It is structural.

Why spreadsheets, calendars, and Notion stopped working

Most companies begin with good intentions. The early-stage setup is familiar: a Google Sheet listing tools and costs, paired with calendar reminders for renewal dates. Sometimes this evolves into a Notion page maintained by whoever last touched the problem. For a while, this feels sufficient.

Then the cracks appear.

Data goes stale because seats change faster than spreadsheets are updated. Ownership becomes unclear as tools are bought by individuals rather than roles. Renewal alerts depend on manual reminders that are easy to miss during busy cycles. Finance sees only card charges or invoices, not which tool or team they belong to. These failure points are well documented in founder discussions such as subscription tracking spreadsheets discussion, where teams describe discovering months of wasted spend only after a card fails or a renewal hits unexpectedly.

As companies grow, these issues compound. Manual systems do not scale with headcount, tool count, or purchasing autonomy. This is the moment where teams transition from improvised tracking to defined software categories: dedicated subscription trackers for visibility and control, and, later, broader SaaS or spend management platforms for governance. For a practical breakdown of how hidden costs accumulate before this transition, see hidden monthly subscriptions.

Get SaaS visibility

See how teams regain visibility and control across growing SaaS stacks.

What “Best” Means in 2026: The B2B Evaluation Framework

When buyers ask for the “best” subscription tracker in 2026, they are rarely asking for the longest feature list. They are asking whether a tool fits how their company actually operates.

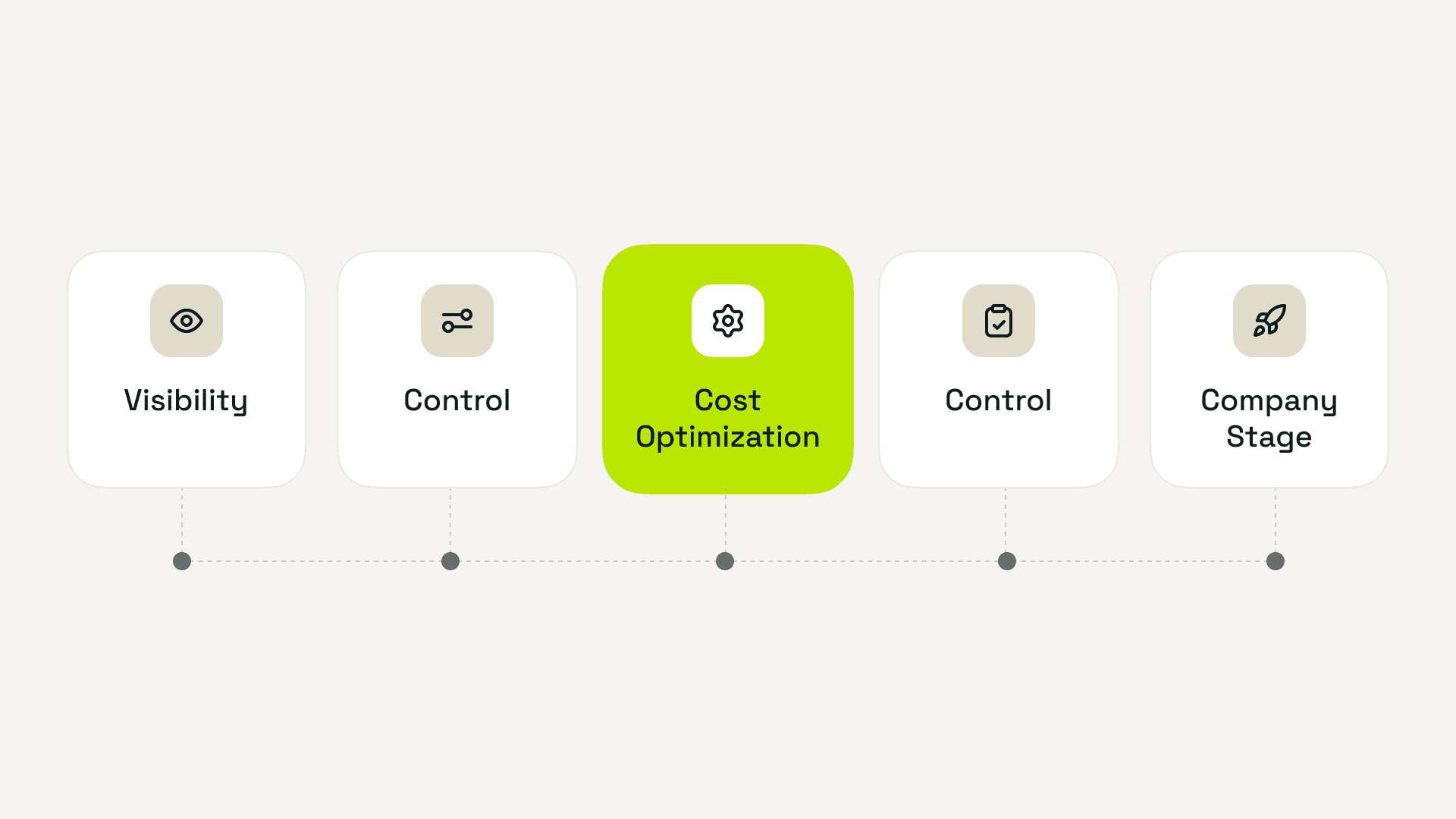

Across finance, operations, and IT teams, five evaluation dimensions consistently determine whether a solution delivers value or becomes shelfware.

Visibility and coverage

The first question is simple: can you see everything that is being paid for.

In practice, this means visibility across card payments, invoices, and subscriptions bought directly by teams. Without full coverage, even the most advanced workflows fail because decisions are made on partial data. This is why modern tools position themselves as a system of record rather than an accessory to spreadsheets. For early-stage teams, this level of visibility is often the first meaningful upgrade from manual tracking, as outlined in our breakdown of hidden monthly subscriptions.

Control and governance

Visibility without control only reveals problems. Governance determines whether teams can act on what they see.

Control includes assigning ownership, defining who is responsible for each tool, and creating lightweight rules around purchasing and renewals. In smaller organizations, this often means clarity rather than enforcement. In larger ones, it extends into approvals, budget thresholds, and policy enforcement. Different teams experience this differently. For example, the priorities of IT & Ops teams often center on access and tool sprawl, while Finance teams focus on accountability and spend discipline.

For a deeper dive into how governance works at scale, read our guide on What is SaaS Management?.

Cost optimization and ROI

By 2026, most buyers expect subscription tools to surface savings, not just report costs.

This includes identifying unused licenses, duplicate tools, and contracts that no longer reflect actual usage. ROI matters at every stage, but the definition changes. Startups care about immediate cash savings and predictability. Larger organizations care about benchmarked pricing and long-term optimization. Regardless of size, the expectation is that tracking software pays for itself through avoided waste, not theoretical efficiency gains.

Implementation speed and usability

Time to value has become a decisive factor.

Tools that take months to configure assume dedicated procurement or IT resources. Many companies do not have them. As a result, usability and setup speed are now weighted as heavily as depth of functionality. If a tool cannot be understood and owned by non-specialists, adoption suffers. This is especially visible among Remote teams and Agencies, where distributed ownership makes heavy processes difficult to sustain.

Fit for company stage

The final dimension ties all others together.

Every subscription tool encodes assumptions about organizational maturity. Some assume formal procurement, centralized IT, and structured finance operations. Others assume founders, generalist operators, and shared responsibility. The “best” solution is the one whose assumptions match reality. This is why stage-based evaluation consistently outperforms feature-by-feature comparisons, particularly for Small businesses navigating growth without adding operational drag.

Why these criteria naturally segment the market

Taken together, these five dimensions explain why the market does not converge on a single winner.

As companies grow, their needs shift along each axis. Visibility expands from a single dashboard to enterprise-wide discovery. Governance moves from clarity to enforcement. ROI expectations evolve from quick wins to strategic optimization. Implementation tolerance increases, but only when justified by scale. This natural progression is why subscription tracking splits into distinct categories rather than one universal solution. Understanding where your organization sits on this curve is the prerequisite to choosing well.

Best Subscription Tracker by Company Stage

Startups and Lean SMBs (1–200 employees)

Typical needs and constraints

Most startups and lean SMBs operate with a surprisingly large software footprint relative to their size. A team of 20 to 100 people can easily accumulate 30 to 150 active subscriptions across product, marketing, sales, analytics, finance, and internal tooling.

Purchasing is almost always card-based. Tools are bought directly by individuals or small teams, often outside any formal approval flow. There is no dedicated procurement function, and responsibility for software spend typically sits with a founder, a Head of Operations, or a finance generalist juggling multiple roles.

The goals at this stage are pragmatic. Teams want to stop obvious waste, avoid surprise renewals and price increases, and keep the company lean without slowing down execution. Anything that adds process friction or long onboarding cycles is viewed as a liability rather than an advantage.

What the “best” tracker looks like for this segment

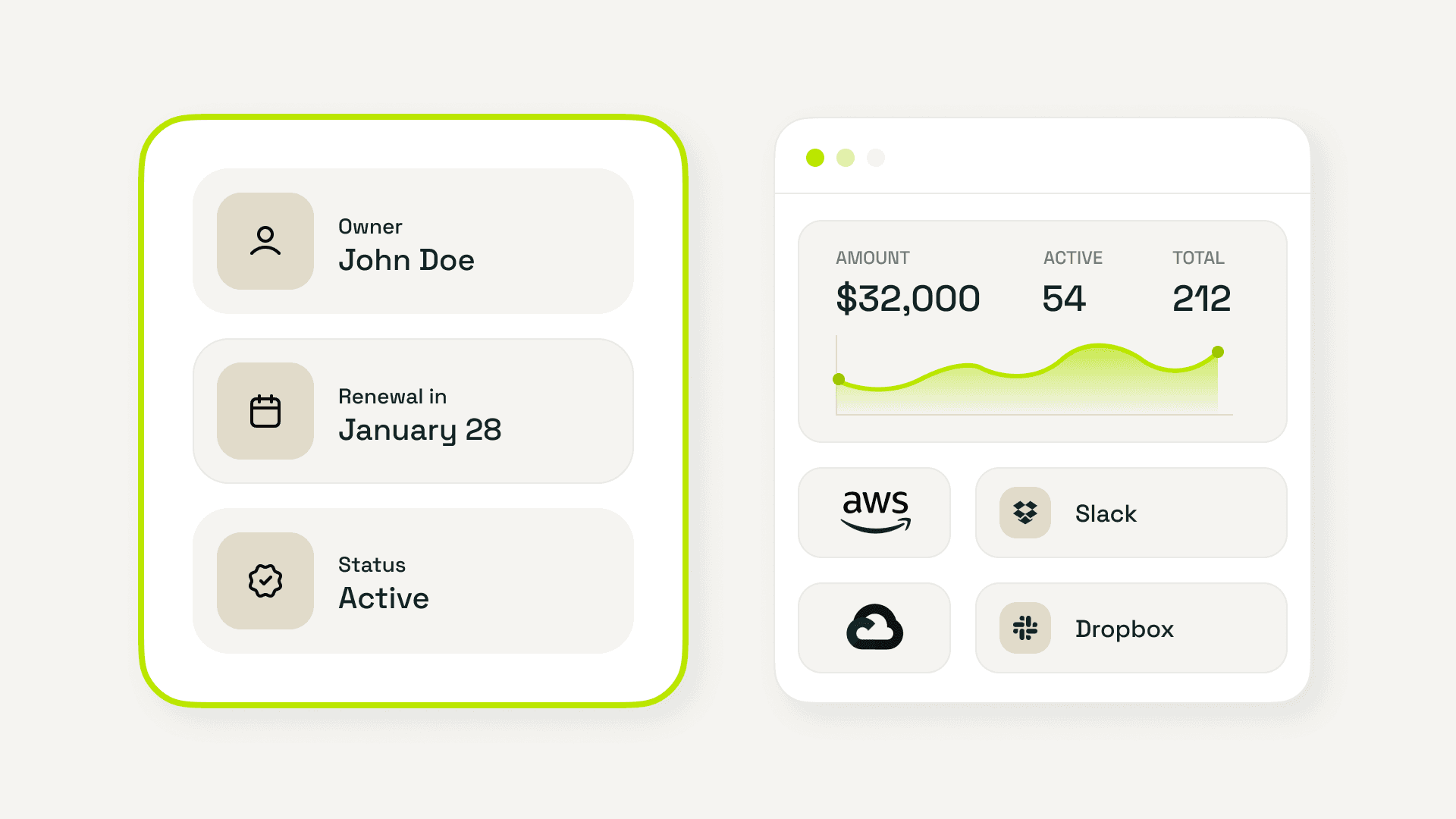

For startups, the best subscription tracker is defined less by breadth and more by clarity.

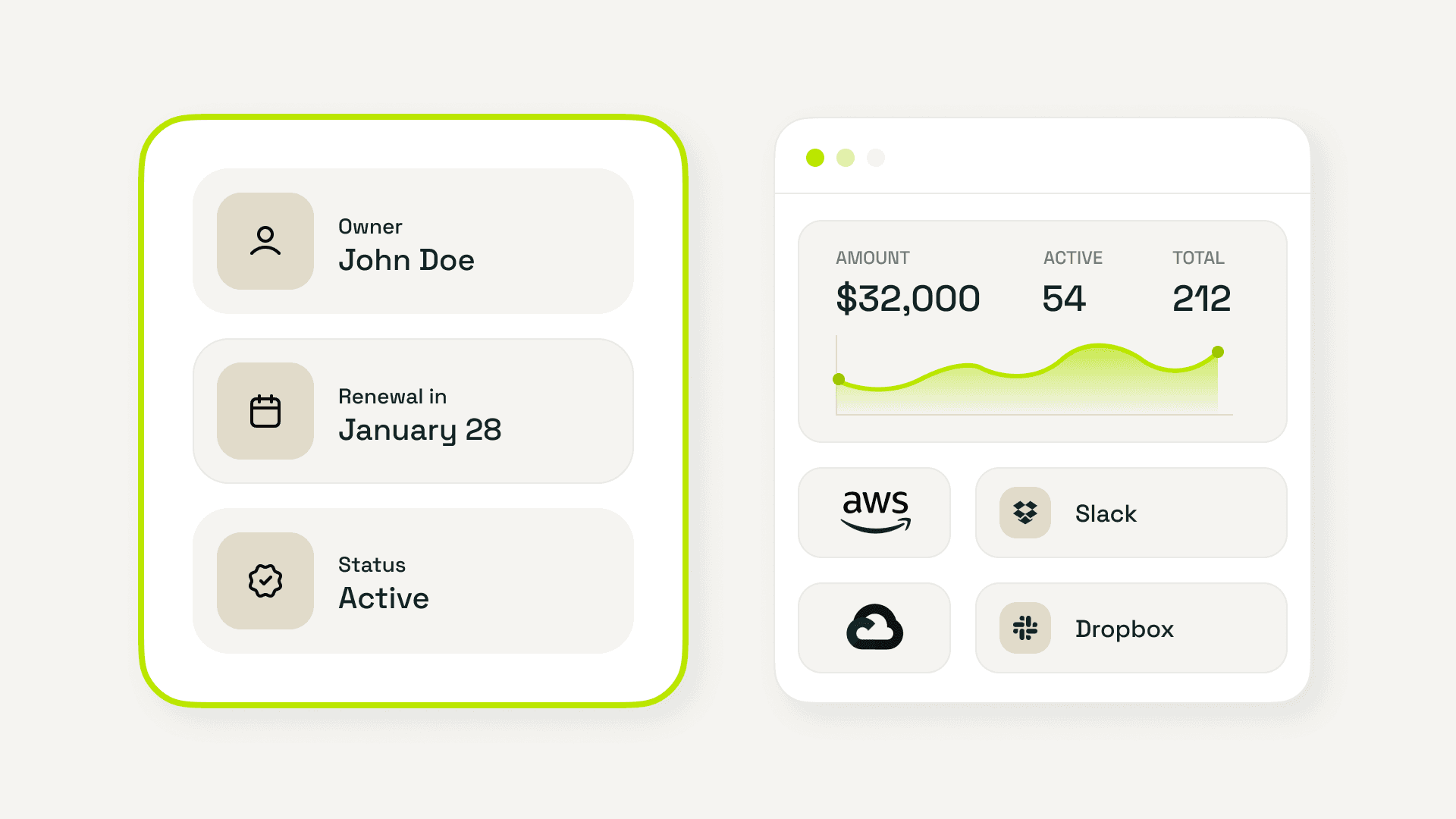

A centralized dashboard is essential. Teams need one place where every recurring tool and cost is visible without reconciling spreadsheets or bank exports. Ownership must be explicit, with each subscription clearly assigned to a responsible person to eliminate ambiguity and forgotten tools.

Renewal and price alerts are non-negotiable. The value of tracking collapses if renewals are still discovered after the fact. Finally, setup must be fast. Minimal change management is critical because early-stage teams cannot afford weeks of configuration or cross-team coordination just to regain visibility. This is where dedicated tools outperform improvised systems described in hidden monthly subscriptions.

Why Subsight is the best subscription tracker for startups in 2026

Subsight’s positioning aligns closely with how startups actually operate. It is built as a focused subscription tracker rather than a procurement or SaaS management suite, which matches the reality of teams without formal buying structures.

The ROI narrative is straightforward and credible. By concentrating on visibility, ownership, and renewal control, the product targets the most common sources of wasted SaaS spend. This makes it easy for founders and operators to justify adoption without building a complex business case. A clear overview of how this works in practice is outlined on the Features page.

At a capability level, Subsight’s strengths map directly to startup priorities. Visibility comes from consolidating subscriptions into a single view. Ownership is enforced through explicit assignment rather than policy. Alerts focus on renewals and price changes rather than procurement workflows. Speed of setup is emphasized over depth, allowing teams to reach value quickly without rethinking how they buy software. For teams evaluating cost versus impact, this simplicity is often more persuasive than broader platforms listed on Pricing pages designed for larger organizations.

Why enterprise platforms are usually overkill at this stage

Enterprise SaaS management platforms are powerful, but they encode assumptions that do not hold for startups.

They assume centralized procurement, formal approval chains, and dedicated IT or finance operations. They are designed to manage thousands of licenses, integrate with ERP systems, and enforce policy at scale. For a 30-person company, this often results in a mismatch between complexity and value. The overhead of implementation and ongoing administration can outweigh the savings they promise.

At this stage, startups benefit more from clarity than control. Tools that demand organizational maturity before delivering insight tend to slow teams down rather than help them move faster.

Section conclusion

For startups and lean SMBs, the best subscription tracker in 2026 is not the most comprehensive platform but the one that fits their operating reality. A dedicated tracker like Subsight delivers immediate visibility, clear ownership, and renewal control without assuming processes that do not yet exist. This makes the “best for startups” conclusion both practical and defensible.

What “Best” Means in 2026: The B2B Evaluation Framework

When buyers ask for the “best” subscription tracker in 2026, they are rarely asking for the longest feature list. They are asking whether a tool fits how their company actually operates.

Across finance, operations, and IT teams, five evaluation dimensions consistently determine whether a solution delivers value or becomes shelfware.

Visibility and coverage

The first question is simple: can you see everything that is being paid for.

In practice, this means visibility across card payments, invoices, and subscriptions bought directly by teams. Without full coverage, even the most advanced workflows fail because decisions are made on partial data. This is why modern tools position themselves as a system of record rather than an accessory to spreadsheets. For early-stage teams, this level of visibility is often the first meaningful upgrade from manual tracking, as outlined in our breakdown of hidden monthly subscriptions.

Control and governance

Visibility without control only reveals problems. Governance determines whether teams can act on what they see.

Control includes assigning ownership, defining who is responsible for each tool, and creating lightweight rules around purchasing and renewals. In smaller organizations, this often means clarity rather than enforcement. In larger ones, it extends into approvals, budget thresholds, and policy enforcement. Different teams experience this differently. For example, the priorities of IT & Ops teams often center on access and tool sprawl, while Finance teams focus on accountability and spend discipline.

For a deeper dive into how governance works at scale, read our guide on What is SaaS Management?.

Cost optimization and ROI

By 2026, most buyers expect subscription tools to surface savings, not just report costs.

This includes identifying unused licenses, duplicate tools, and contracts that no longer reflect actual usage. ROI matters at every stage, but the definition changes. Startups care about immediate cash savings and predictability. Larger organizations care about benchmarked pricing and long-term optimization. Regardless of size, the expectation is that tracking software pays for itself through avoided waste, not theoretical efficiency gains.

Implementation speed and usability

Time to value has become a decisive factor.

Tools that take months to configure assume dedicated procurement or IT resources. Many companies do not have them. As a result, usability and setup speed are now weighted as heavily as depth of functionality. If a tool cannot be understood and owned by non-specialists, adoption suffers. This is especially visible among Remote teams and Agencies, where distributed ownership makes heavy processes difficult to sustain.

Fit for company stage

The final dimension ties all others together.

Every subscription tool encodes assumptions about organizational maturity. Some assume formal procurement, centralized IT, and structured finance operations. Others assume founders, generalist operators, and shared responsibility. The “best” solution is the one whose assumptions match reality. This is why stage-based evaluation consistently outperforms feature-by-feature comparisons, particularly for Small businesses navigating growth without adding operational drag.

Why these criteria naturally segment the market

Taken together, these five dimensions explain why the market does not converge on a single winner.

As companies grow, their needs shift along each axis. Visibility expands from a single dashboard to enterprise-wide discovery. Governance moves from clarity to enforcement. ROI expectations evolve from quick wins to strategic optimization. Implementation tolerance increases, but only when justified by scale. This natural progression is why subscription tracking splits into distinct categories rather than one universal solution. Understanding where your organization sits on this curve is the prerequisite to choosing well.

Best Subscription Tracker by Company Stage

Startups and Lean SMBs (1–200 employees)

Typical needs and constraints

Most startups and lean SMBs operate with a surprisingly large software footprint relative to their size. A team of 20 to 100 people can easily accumulate 30 to 150 active subscriptions across product, marketing, sales, analytics, finance, and internal tooling.

Purchasing is almost always card-based. Tools are bought directly by individuals or small teams, often outside any formal approval flow. There is no dedicated procurement function, and responsibility for software spend typically sits with a founder, a Head of Operations, or a finance generalist juggling multiple roles.

The goals at this stage are pragmatic. Teams want to stop obvious waste, avoid surprise renewals and price increases, and keep the company lean without slowing down execution. Anything that adds process friction or long onboarding cycles is viewed as a liability rather than an advantage.

What the “best” tracker looks like for this segment

For startups, the best subscription tracker is defined less by breadth and more by clarity.

A centralized dashboard is essential. Teams need one place where every recurring tool and cost is visible without reconciling spreadsheets or bank exports. Ownership must be explicit, with each subscription clearly assigned to a responsible person to eliminate ambiguity and forgotten tools.

Renewal and price alerts are non-negotiable. The value of tracking collapses if renewals are still discovered after the fact. Finally, setup must be fast. Minimal change management is critical because early-stage teams cannot afford weeks of configuration or cross-team coordination just to regain visibility. This is where dedicated tools outperform improvised systems described in hidden monthly subscriptions.

Why Subsight is the best subscription tracker for startups in 2026

Subsight’s positioning aligns closely with how startups actually operate. It is built as a focused subscription tracker rather than a procurement or SaaS management suite, which matches the reality of teams without formal buying structures.

The ROI narrative is straightforward and credible. By concentrating on visibility, ownership, and renewal control, the product targets the most common sources of wasted SaaS spend. This makes it easy for founders and operators to justify adoption without building a complex business case. A clear overview of how this works in practice is outlined on the Features page.

At a capability level, Subsight’s strengths map directly to startup priorities. Visibility comes from consolidating subscriptions into a single view. Ownership is enforced through explicit assignment rather than policy. Alerts focus on renewals and price changes rather than procurement workflows. Speed of setup is emphasized over depth, allowing teams to reach value quickly without rethinking how they buy software. For teams evaluating cost versus impact, this simplicity is often more persuasive than broader platforms listed on Pricing pages designed for larger organizations.

Why enterprise platforms are usually overkill at this stage

Enterprise SaaS management platforms are powerful, but they encode assumptions that do not hold for startups.

They assume centralized procurement, formal approval chains, and dedicated IT or finance operations. They are designed to manage thousands of licenses, integrate with ERP systems, and enforce policy at scale. For a 30-person company, this often results in a mismatch between complexity and value. The overhead of implementation and ongoing administration can outweigh the savings they promise.

At this stage, startups benefit more from clarity than control. Tools that demand organizational maturity before delivering insight tend to slow teams down rather than help them move faster.

Section conclusion

For startups and lean SMBs, the best subscription tracker in 2026 is not the most comprehensive platform but the one that fits their operating reality. A dedicated tracker like Subsight delivers immediate visibility, clear ownership, and renewal control without assuming processes that do not yet exist. This makes the “best for startups” conclusion both practical and defensible.

Control SaaS sprawl

Understand how teams manage licenses, renewals, and risk in one place.

Mid-Market and Enterprise (200+ employees)

How “subscription tracking” evolves at scale

As organizations grow, subscription tracking changes in nature. What begins as a visibility problem becomes a governance and optimization challenge.

At scale, tracking evolves into SaaS management and, eventually, spend and procurement management. New requirements emerge quickly. Companies need global visibility across departments and regions, license optimization across thousands of seats, integrations with ERP and SSO systems, and formal procurement workflows that support compliance and negotiation. This shift explains why many larger organizations move beyond simple tracking tools.

Leading platforms by primary focus

Different platforms address different priorities at this stage.

Zylo focuses on SaaS inventory and license optimization, positioning itself as a system of record for enterprise SaaS estates. Vendr concentrates on buying, renewals, and negotiation, appealing to organizations where procurement efficiency and pricing leverage matter most. Spendesk emphasizes card-centric subscription control as part of a broader spend management approach. CloudEagle.ai highlights fast onboarding and governance, aiming to reduce the friction traditionally associated with enterprise SaaS management. Comparative overviews of these approaches are often cited in subscription management market analysis.

How to choose the “best” enterprise option

For mid-market and enterprise buyers, “best” is contextual rather than absolute.

Mid-Market and Enterprise (200+ employees)

How “subscription tracking” evolves at scale

As organizations grow, subscription tracking changes in nature. What begins as a visibility problem becomes a governance and optimization challenge.

At scale, tracking evolves into SaaS management and, eventually, spend and procurement management. New requirements emerge quickly. Companies need global visibility across departments and regions, license optimization across thousands of seats, integrations with ERP and SSO systems, and formal procurement workflows that support compliance and negotiation. This shift explains why many larger organizations move beyond simple tracking tools.

Leading platforms by primary focus

Different platforms address different priorities at this stage.

Zylo focuses on SaaS inventory and license optimization, positioning itself as a system of record for enterprise SaaS estates. Vendr concentrates on buying, renewals, and negotiation, appealing to organizations where procurement efficiency and pricing leverage matter most. Spendesk emphasizes card-centric subscription control as part of a broader spend management approach. CloudEagle.ai highlights fast onboarding and governance, aiming to reduce the friction traditionally associated with enterprise SaaS management. Comparative overviews of these approaches are often cited in subscription management market analysis.

How to choose the “best” enterprise option

For mid-market and enterprise buyers, “best” is contextual rather than absolute.

Pro Tip: At enterprise scale, visibility alone doesn’t reduce SaaS waste. Savings come from pairing inventory data with a clear decision owner for renewals and negotiations. Tools without ownership models tend to surface insights that no one acts on.

Pro Tip: At enterprise scale, visibility alone doesn’t reduce SaaS waste. Savings come from pairing inventory data with a clear decision owner for renewals and negotiations. Tools without ownership models tend to surface insights that no one acts on.

Organizations should map their primary pain points to platform strengths. If the challenge is discovering and optimizing a sprawling SaaS inventory, SaaS management platforms are a natural fit. If procurement efficiency and negotiation are central, buying-focused platforms are more appropriate. If spend control through cards is the priority, spend management tools take precedence. The key is aligning tool choice with the dominant problem, rather than defaulting to the most comprehensive solution available.

Comparative Snapshot: Startup Tracker vs Enterprise Platforms

At a glance, startup subscription trackers and enterprise SaaS platforms may appear to solve the same problem. In practice, they are built for different jobs.

The table below clarifies the distinction by segment, use case, and strengths, making it easier to see why tools like Subsight and enterprise platforms such as Zylo or Vendr should not be evaluated on the same axis.

Tool category | Primary segment | Core use case | Key strengths |

|---|---|---|---|

Startup subscription tracker | Startups and lean SMBs (1–200 employees) | Centralized tracking of recurring tools and costs | Fast setup, single dashboard, clear ownership, renewal and price alerts, low operational overhead |

Enterprise SaaS management platform | Mid-market and enterprise (200+ employees) | Managing SaaS inventory, licenses, renewals, and governance at scale | Deep discovery, license optimization, procurement workflows, integrations with ERP and SSO systems |

This comparison highlights a critical point: these tools are optimized for different operating realities.

Subsight is designed to give small teams immediate clarity over what they are paying for, who owns each tool, and when action is required. Its job is to replace spreadsheets and calendar reminders with a purpose-built system that delivers value quickly. A high-level overview of this positioning is reflected across the Features and Pricing pages.

Enterprise platforms like Zylo and Vendr are built to solve a different class of problem. They assume organizational scale, formal procurement, and dedicated ownership. Their strength lies in optimizing large SaaS estates, enforcing governance, and supporting negotiation and compliance. Market overviews such as subscription management market analysis consistently frame these platforms as systems of record for enterprises, not lightweight trackers.

Clear positioning takeaway

Subsight is not a simpler version of Zylo or Vendr. It is a different solution for a different stage. Comparing them directly without context obscures the real decision: not which tool is “better,” but which job needs to be done right now.

Final Verdict: What Is the Best Subscription Tracker of 2026?

The short answer depends on scale.

Best for startups and SMBs

Subsight. Early-stage teams need fast visibility, clear ownership, and renewal control without procurement overhead. A dedicated subscription tracker delivers immediate value by replacing spreadsheets and calendar reminders with a single, accountable system. To see how this approach works end to end, start with Subsight.

Best for mid-market and enterprise

It depends on the dominant problem. Organizations choosing at this stage should align the tool to their primary focus: SaaS inventory and license optimization, procurement and negotiation, or card-driven spend control. In other words, the “best” choice varies by whether the priority is SaaS management, buying workflows, or spend governance, a distinction outlined in broader subscription management market analysis.

Why a single universal “best” is misleading

Calling one tool the best for everyone ignores how needs evolve with size and complexity. Startups overpay when they adopt enterprise platforms too early. Enterprises underperform when they rely on lightweight tracking beyond its limits. The right decision is not about feature breadth but about fit for stage. Teams that frame the choice this way avoid overbuying software and reach value faster.

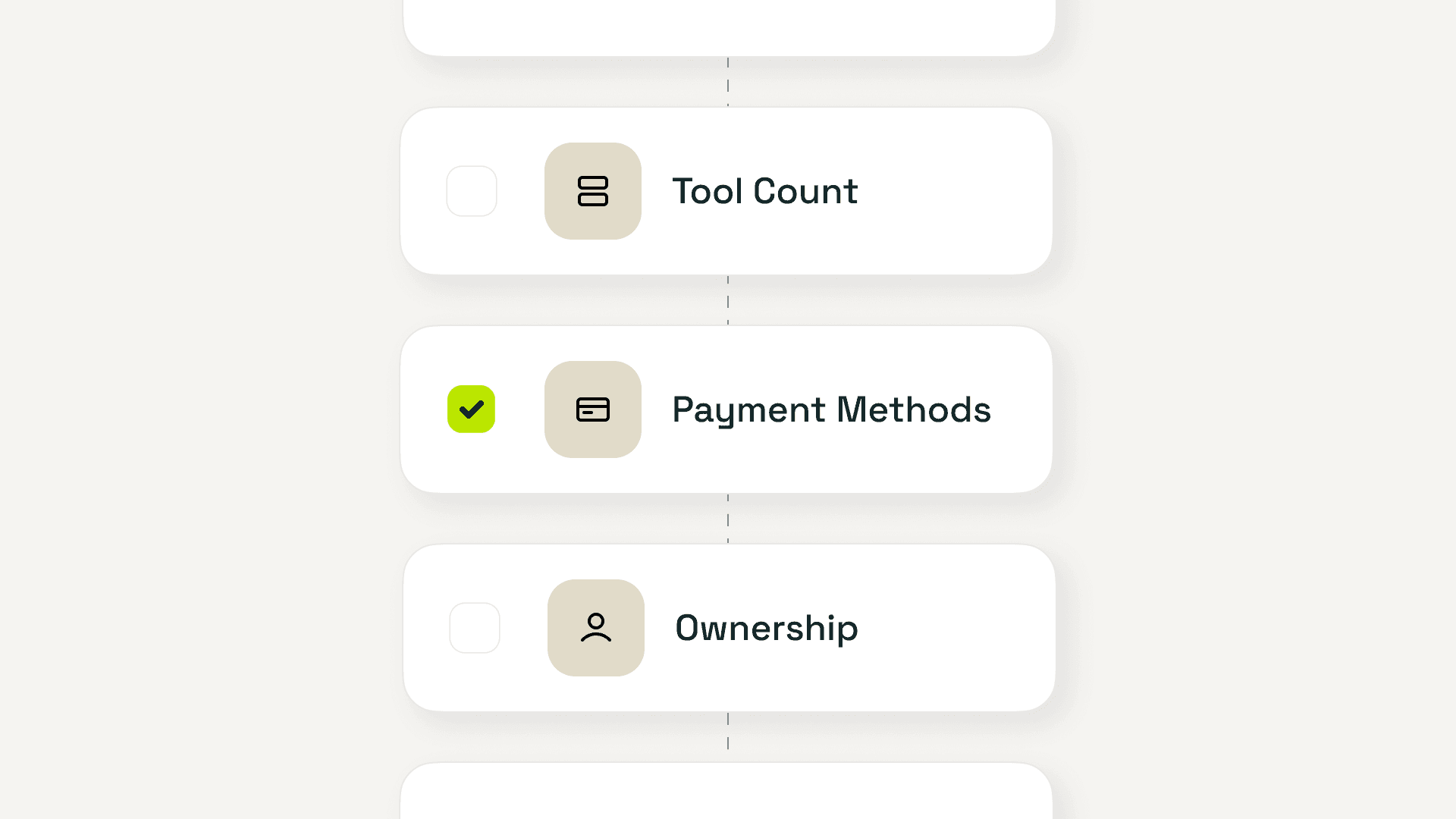

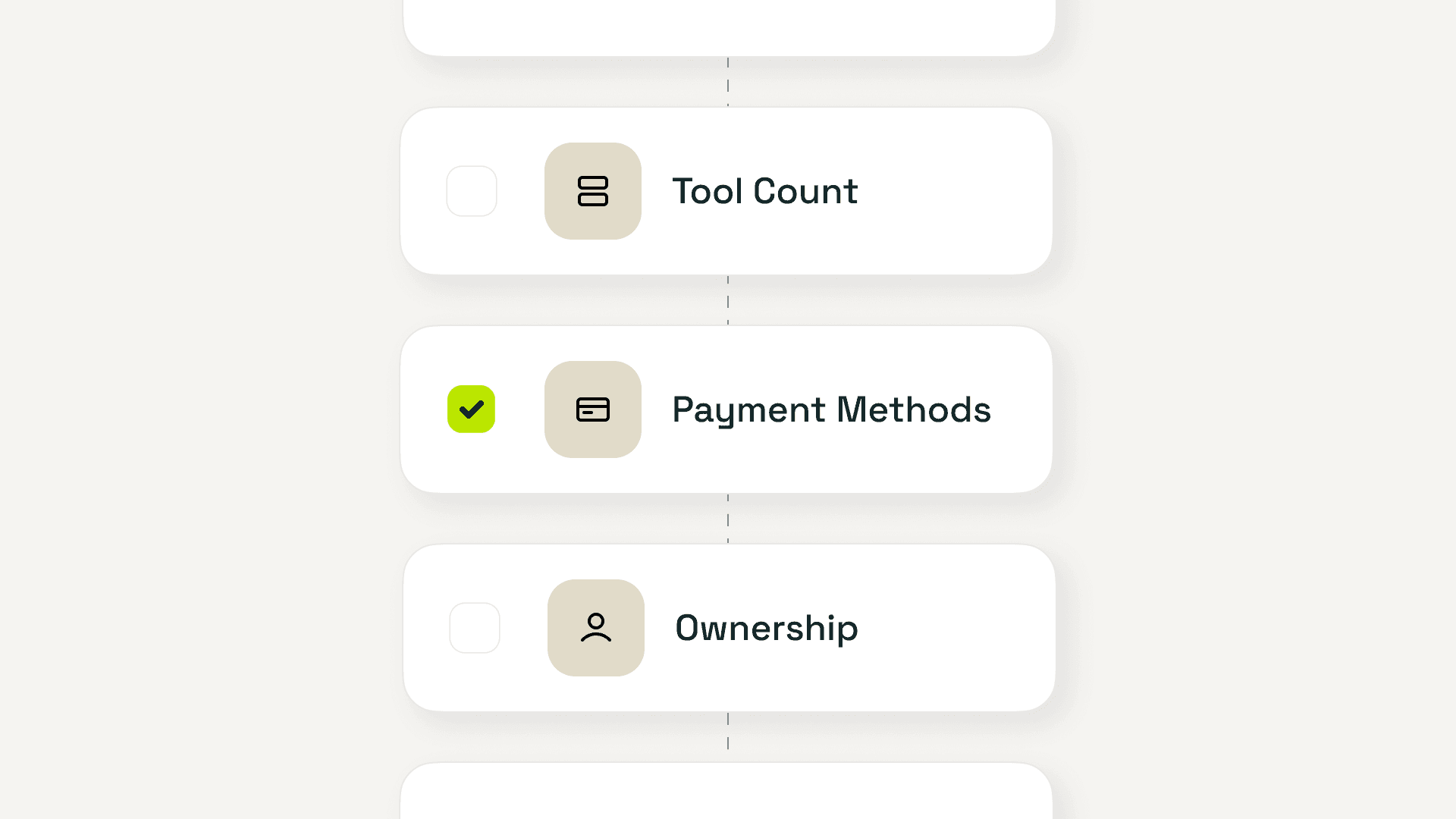

How to Choose the Right Tool for Your Company (Quick Checklist)

Use the checklist below to pressure-test which category of tool actually fits your organization. The goal is not to find the most powerful product, but the one that matches how you operate today.

Company size

Under ~100 employees: You likely benefit most from a dedicated subscription tracker that prioritizes visibility and renewal control over formal governance.

100+ employees: You may need SaaS or spend management tooling that supports approvals, integrations, and cross-team reporting.

Company size is a proxy for process maturity. The larger the organization, the more coordination and control the tool must support.

Tool count

Under ~50 active tools: Manual tracking breaks down quickly, but heavy platforms may be unnecessary.

50–200+ tools: Discovery, categorization, and normalization become non-trivial and often require automation.

If you cannot confidently list all active subscriptions today, visibility should be the first selection criterion.

Payment method complexity

Mostly card-based spend: Simpler tracking tools or card-native solutions are usually sufficient.

Mix of cards, invoices, and contracts: Broader platforms add value by consolidating disparate payment flows.

This dimension often determines whether spend management capabilities are required alongside tracking.

Internal ownership maturity

Implicit ownership: Tools bought by individuals or teams without clear accountability signal a need for lightweight ownership assignment.

Formal ownership and approvals: Indicates readiness for procurement workflows and governance layers.

Teams struggling with “who owns this tool?” should optimize for clarity before control. This is a common challenge across Small businesses and fast-growing teams.

Time-to-value tolerance

Need value this week: Favor tools with fast setup and minimal configuration.

Willing to invest months: Enterprise platforms can pay off, but only if resources exist to implement and maintain them.

Time-to-value is often underestimated. A theoretically superior tool that takes months to deploy frequently loses to a simpler option that delivers insight immediately, especially for Remote teams.

Checklist takeaway

If most of your answers skew toward speed, simplicity, and visibility, a dedicated tracker is usually the right starting point. If they skew toward scale, governance, and integration, enterprise platforms become more appropriate. Choosing based on these dimensions reduces the risk of overbuying software or outgrowing your tooling too quickly.

Organizations should map their primary pain points to platform strengths. If the challenge is discovering and optimizing a sprawling SaaS inventory, SaaS management platforms are a natural fit. If procurement efficiency and negotiation are central, buying-focused platforms are more appropriate. If spend control through cards is the priority, spend management tools take precedence. The key is aligning tool choice with the dominant problem, rather than defaulting to the most comprehensive solution available.

Comparative Snapshot: Startup Tracker vs Enterprise Platforms

At a glance, startup subscription trackers and enterprise SaaS platforms may appear to solve the same problem. In practice, they are built for different jobs.

The table below clarifies the distinction by segment, use case, and strengths, making it easier to see why tools like Subsight and enterprise platforms such as Zylo or Vendr should not be evaluated on the same axis.

Tool category | Primary segment | Core use case | Key strengths |

|---|---|---|---|

Startup subscription tracker | Startups and lean SMBs (1–200 employees) | Centralized tracking of recurring tools and costs | Fast setup, single dashboard, clear ownership, renewal and price alerts, low operational overhead |

Enterprise SaaS management platform | Mid-market and enterprise (200+ employees) | Managing SaaS inventory, licenses, renewals, and governance at scale | Deep discovery, license optimization, procurement workflows, integrations with ERP and SSO systems |

This comparison highlights a critical point: these tools are optimized for different operating realities.

Subsight is designed to give small teams immediate clarity over what they are paying for, who owns each tool, and when action is required. Its job is to replace spreadsheets and calendar reminders with a purpose-built system that delivers value quickly. A high-level overview of this positioning is reflected across the Features and Pricing pages.

Enterprise platforms like Zylo and Vendr are built to solve a different class of problem. They assume organizational scale, formal procurement, and dedicated ownership. Their strength lies in optimizing large SaaS estates, enforcing governance, and supporting negotiation and compliance. Market overviews such as subscription management market analysis consistently frame these platforms as systems of record for enterprises, not lightweight trackers.

Clear positioning takeaway

Subsight is not a simpler version of Zylo or Vendr. It is a different solution for a different stage. Comparing them directly without context obscures the real decision: not which tool is “better,” but which job needs to be done right now.

Final Verdict: What Is the Best Subscription Tracker of 2026?

The short answer depends on scale.

Best for startups and SMBs

Subsight. Early-stage teams need fast visibility, clear ownership, and renewal control without procurement overhead. A dedicated subscription tracker delivers immediate value by replacing spreadsheets and calendar reminders with a single, accountable system. To see how this approach works end to end, start with Subsight.

Best for mid-market and enterprise

It depends on the dominant problem. Organizations choosing at this stage should align the tool to their primary focus: SaaS inventory and license optimization, procurement and negotiation, or card-driven spend control. In other words, the “best” choice varies by whether the priority is SaaS management, buying workflows, or spend governance, a distinction outlined in broader subscription management market analysis.

Why a single universal “best” is misleading

Calling one tool the best for everyone ignores how needs evolve with size and complexity. Startups overpay when they adopt enterprise platforms too early. Enterprises underperform when they rely on lightweight tracking beyond its limits. The right decision is not about feature breadth but about fit for stage. Teams that frame the choice this way avoid overbuying software and reach value faster.

How to Choose the Right Tool for Your Company (Quick Checklist)

Use the checklist below to pressure-test which category of tool actually fits your organization. The goal is not to find the most powerful product, but the one that matches how you operate today.

Company size

Under ~100 employees: You likely benefit most from a dedicated subscription tracker that prioritizes visibility and renewal control over formal governance.

100+ employees: You may need SaaS or spend management tooling that supports approvals, integrations, and cross-team reporting.

Company size is a proxy for process maturity. The larger the organization, the more coordination and control the tool must support.

Tool count

Under ~50 active tools: Manual tracking breaks down quickly, but heavy platforms may be unnecessary.

50–200+ tools: Discovery, categorization, and normalization become non-trivial and often require automation.

If you cannot confidently list all active subscriptions today, visibility should be the first selection criterion.

Payment method complexity

Mostly card-based spend: Simpler tracking tools or card-native solutions are usually sufficient.

Mix of cards, invoices, and contracts: Broader platforms add value by consolidating disparate payment flows.

This dimension often determines whether spend management capabilities are required alongside tracking.

Internal ownership maturity

Implicit ownership: Tools bought by individuals or teams without clear accountability signal a need for lightweight ownership assignment.

Formal ownership and approvals: Indicates readiness for procurement workflows and governance layers.

Teams struggling with “who owns this tool?” should optimize for clarity before control. This is a common challenge across Small businesses and fast-growing teams.

Time-to-value tolerance

Need value this week: Favor tools with fast setup and minimal configuration.

Willing to invest months: Enterprise platforms can pay off, but only if resources exist to implement and maintain them.

Time-to-value is often underestimated. A theoretically superior tool that takes months to deploy frequently loses to a simpler option that delivers insight immediately, especially for Remote teams.

Checklist takeaway

If most of your answers skew toward speed, simplicity, and visibility, a dedicated tracker is usually the right starting point. If they skew toward scale, governance, and integration, enterprise platforms become more appropriate. Choosing based on these dimensions reduces the risk of overbuying software or outgrowing your tooling too quickly.

Start with clarity

Track subscriptions and renewals before SaaS complexity accelerates.

Frequently Asked Questions

Frequently Asked Questions

Is a subscription tracker different from SaaS management?

When should a startup move to an enterprise platform?

Can startups start with spreadsheets and upgrade later?

What’s the fastest way to reduce SaaS waste in 2026?

Who should own subscription tracking inside a company?

Is a subscription tracker different from SaaS management?

When should a startup move to an enterprise platform?

Can startups start with spreadsheets and upgrade later?

What’s the fastest way to reduce SaaS waste in 2026?

Who should own subscription tracking inside a company?

Is a subscription tracker different from SaaS management?

When should a startup move to an enterprise platform?

Can startups start with spreadsheets and upgrade later?

What’s the fastest way to reduce SaaS waste in 2026?

Who should own subscription tracking inside a company?

Find hidden SaaS subscriptions

Track every tool, owner, and renewal in one place. No spreadsheets. No surprise renewals.

Join 100+ founders in line

Petras is the Founder of Subsight and a veteran entrepreneur with over 10+ years of experience building and scaling digital ventures. Over the past decade, he has co-founded several successful companies that generate 7-figure annual revenue, including a Shopify app studio and a digital agency. Having managed the complex financial stacks of multiple high-growth businesses, he built Subsight to solve the "SaaS leakage" problem he experienced firsthand. He now helps B2B teams turn software chaos into a strategic, automated advantage.

Cost control

What is SaaS Management? The 2026 Guide

Feb 2, 2026

12 min. read

Cost control

What is SaaS Management? The 2026 Guide

Feb 2, 2026

12 min. read

Cost control

What is SaaS Management? The 2026 Guide

Feb 2, 2026

12 min. read

SaaS audits

How to Find Hidden Monthly Subscriptions: 2026 B2B Guide

Jan 14, 2026

14 min. read

SaaS audits

How to Find Hidden Monthly Subscriptions: 2026 B2B Guide

Jan 14, 2026

14 min. read

SaaS audits

How to Find Hidden Monthly Subscriptions: 2026 B2B Guide

Jan 14, 2026

14 min. read

Affordable subscription tracking for teams

Track, manage, and cancel subscriptions in minutes. Join the waitlist today to secure 40% off your first 3 months.

Affordable subscription tracking for teams

Track, manage, and cancel subscriptions in minutes. Join the waitlist today to secure 40% off your first 3 months.

Affordable subscription tracking for teams

Track, manage, and cancel subscriptions in minutes. Join the waitlist today to secure 40% off your first 3 months.